Louisiana Hurricane Laura & Delta Claims Lawyer

Filing a Hurricane Damage Claim for Residential or Commercial Losses

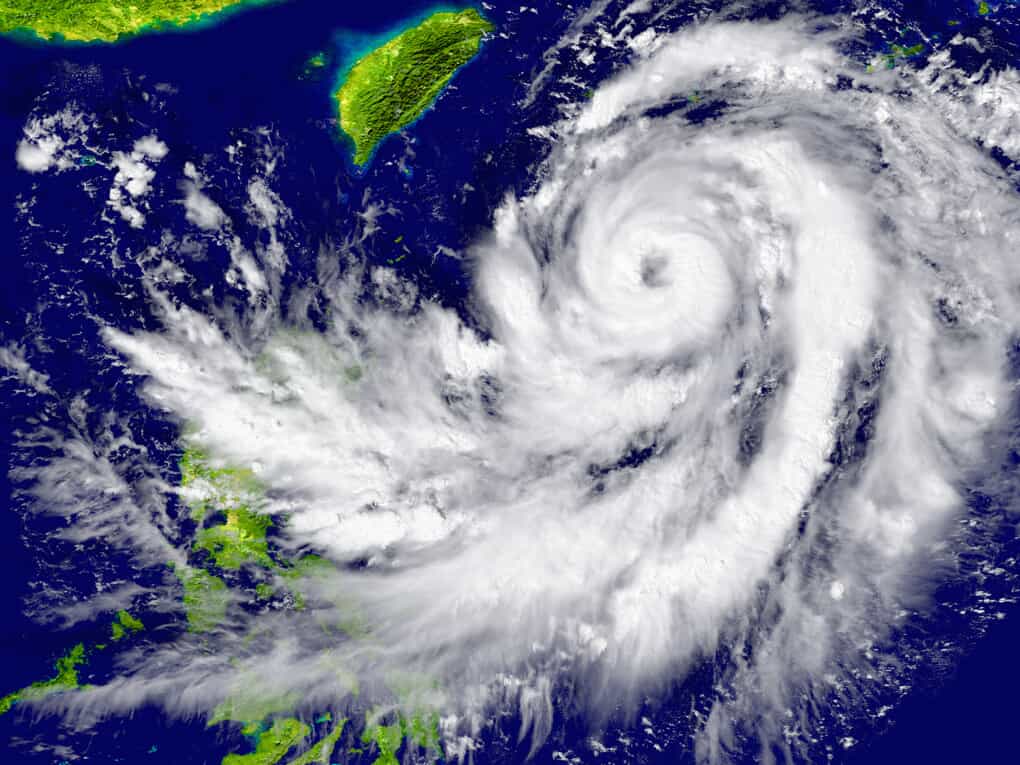

In August of 2020, Hurricane Laura made landfall in Louisiana as a Category 4 hurricane with wind speeds of more than 130 miles per hour. Six short weeks later, in the midst of repairing the damage, Hurricane Delta struck the state as a Category 2 hurricane with sustained winds reaching 110 miles per hour. Together, these two record-setting storms caused massive destruction amounting to billions of dollars in damage throughout Louisiana and Texas.

As residents of Louisiana and Texas, we at Jones & Hill understand the devastating impact Hurricane Laura and Delta had—and continue to have—on our communities. Thousands of homes and businesses were damaged, countless livelihoods and possessions destroyed, and, most tragically, nearly 100 lives lost.

There Is Still Time to File a Hurricane Laura or Delta Claim

If you were affected by Hurricane Laura and/or Hurricane Delta, we can help. At Jones & Hill, we represent claimants who need assistance in filing residential and commercial hurricane damage claims. We recognize that, despite the immense, widespread damage, insurance companies still refuse to fairly pay out claims, leaving communities without the resources they need to heal. Our Louisiana hurricane damage attorneys are prepared to help you fight back against the insurance companies’ efforts to dispute, undervalue, or deny your claim—and we have what it takes to win.

What to Do If You Were Affected by Hurricane Laura/Delta

If you were affected by Hurricane Laura and/or Hurricane Delta, there are certain steps you should take to protect your rights. These steps apply in the wake of any hurricane, tropical storm, or event leading to property damage.

If you have been affected by Hurricane Laura/Delta and have not yet done so, take the following steps:

-

Mitigate the Damage: The first thing you should do after any serious storm is mitigate the damage as much as possible. Remember to only enter your property if it is safe to do so. If possible, cover broken windows and damaged roofs with boards/tarps and take other precautionary measures to prevent additional damage. Doing this can not only reduce further damage but also protect you in the event that your insurance company argues the damage occurred after the hurricane/storm passed.

-

Document Your Losses: Once you have mitigated the damage and it is safe to do so, document your losses. The more documentation you have, the better. We recommend taking pictures of your property and possessions and creating a list of personal items, property, inventory, and other things that were damaged. Thorough documentation can help support your claim and serve as evidence of your losses. It can also help ensure that you do not forget anything that was damaged or lost.

-

Review Your Policy: While you should have a fairly exhaustive understanding of your hurricane insurance policy prior to a disaster, we realize that this may not always be the case. In the wake of the storm, review your policy to better understand your rights. Knowing the specific language of your policy can help empower you when you file your claim and allow you to pursue just compensation for all your covered losses.

- File a Claim: After a hurricane or tropical storm, you should file a claim with your insurance company as soon as possible. As previously mentioned, you typically only have 180 days to file a hurricane insurance claim in Louisiana; even when this deadline is extended, as was the case for Hurricane Laura and Delta claims, the sooner you file, the better. The longer you wait, the more likely it is that your insurance company will question or dispute your claim.

-

Contact an Attorney: The best way to protect your rights after a hurricane damages or destroys your property is to contact an experienced hurricane insurance lawyer. An attorney can not only help you review your policy and file your initial claim but also handle any disputes or disagreements that arise with the insurance company. If necessary, your attorney can also represent you in insurance bad faith proceedings and protect your best interests against those of the insurance company at trial.

At Jones & Hill, we are currently helping victims who were negatively affected by Hurricane Laura and Delta, as well as the entire 2020 hurricane season. Our Louisiana hurricane Laura/Delta claims lawyers are prepared to put their extensive experience, knowledge, and resources on your side to help you fight for the full, fair compensation you are owed by the terms of your policy.

A business interruption claim allows you to seek compensation for specific losses, including but not limited to:

- Lost revenue/income

- Employee payroll

- Temporary relocation costs

- Damage to inventory

- Mortgage, lease, or rent payments

- Loan payments

- Taxes

At Jones & Hill, our Louisiana Hurricane Laura and Delta claims attorneys are well-versed in the complexities of commercial property damage claims. We can help you understand your legal options as a business owner and assist you in seeking fair compensation for your losses. It is critical that you speak to an attorney who can help you navigate this complicated and challenging process; contact us today to learn more during a free initial consultation.

Examples of insurance bad faith include:

-

Unreasonably delaying investigating a claim

-

Denying a claim without providing a reason

-

Failing to conduct a complete investigation

-

Undervaluing a claim (offering less money than the claim is worth)

-

Refusing to pay a rightful claim

-

Threatening a policyholder or raising premiums/deductibles

-

Delaying payment of a valid claim

-

Refusing to provide documentation to the claimant

-

Disputing or denying coverage for losses that are covered by a policy

Unfortunately, insurance companies prioritize profits over the rights and needs of policyholders all the time. If you believe your insurance company is acting wrongfully, turn to our attorneys at Jones & Hill. We have handled numerous insurance bad faith claims and are passionate about ensuring that insurance companies uphold their duty to policyholders.

We can help you fight back against your insurance company’s attempts to dispute, devalue, or deny your claim and work to recover full and fair compensation for your losses after Hurricane Laura/Delta.

How to Tell If Your Homeowners’ Insurance Covers Hurricane Damage

Louisiana is one of several states that has mandatory hurricane deductibles. This means that you must pay a certain amount of money (the deductible) before your insurance kicks in; your insurance company will not pay your claim until you have paid your deductible. What’s more, after Hurricane Katrina, insurance companies rewrote homeowners’ insurance plans to have percentage deductibles instead of dollar deductibles. This means that your deductible is based on the entire insured value of your home, not on your specific losses. In other words, your deductible can translate to a relatively high dollar amount, making it very difficult to get your property repaired.

But how do you know if your homeowners’ insurance covers the damage caused by Hurricane Laura or Delta?

While most homeowners’ insurance policies cover certain types of hurricane- and storm-related damage, like wind damage, other losses are typically not covered. Specifically, flood damage is frequently not covered by homeowners’ insurance.

If your home was damaged due to hurricane-related flooding, you will need additional flood insurance on your homeowners’ insurance policy to be covered for those losses.

Depending on the language of your policy and the specific coverage you have, you may be covered for the following types of losses:

-

Structural damage

-

Damage to roofs, windows, doors, etc.

-

Lost contents, personal items, possessions, furniture, and other belongings

-

Wind-related damage

-

Flooding

Additionally, it is wise to have replacement cost coverage (RCC) rather than actual cash value coverage. RCC ensures that you can have your property repaired or replaced with similar-quality materials without deductions for depreciation. In other words, you can often receive fairer compensation in less time with RCC.

If you are unsure whether you are covered for losses caused by Hurricane Laura or Delta, reach out to Jones & Hill. We are happy to meet with you at no cost to go over your specific hurricane insurance policy and review your coverage with you during an initial consultation.

Why Choose Our Firm?